University of California, Riverside

Investments

Investments

The Office of the Chief Investment Officer of the Regents (UC Investments) manages the University of California investment portfolio and provides fiduciary oversight. This portfolio includes retirement, endowment, and cash assets. As of May 2024, the portfolio totaled approximately $175 billion. Retirement assets, including both pensions and savings, comprise about 74% of the portfolio. Endowment assets, most of which are in an investment pool called the General Endowment Pool, comprise about 14%. Cash assets, also referred to as working capital, comprise about 11%.

At the May 14, 2024, meeting of the UC Regents, the Chief Investment Officer provided information about UC holdings in the following six areas:

|

|

Invested Amount ($ billions) |

Invested Amount (% of total portfolio) |

|

|

Invested Amount |

Invested Amount |

|

Weapons manufacturers |

$3.3 |

1.9% |

|

Companies or entities supporting Israel |

$12.0 |

6.9% |

|

Blackrock |

$0.163 |

0.1% |

|

Investments managed by Blackrock |

$2.1 |

1.2% |

|

Blackstone |

$8.6 |

4.9% |

|

24 companies identified by students |

$3.2 |

1.8% |

|

Total* |

$29.36 |

16.8% |

Source: https://www.youtube.com/live/83rqz-UuWro (beginning at 1:45:30).

*The total reported in the May 14 meeting was $32 billion. UC Riverside is currently working with UC Investments to verify the reported numbers.

The Chief Investment Officer also made the following points:

- UC Investments has not actively decided to invest in any weapons manufacturer. Instead, holdings in weapons manufacturers are through index funds.

- Holdings in companies or entities supporting Israel are comprised of U.S. Treasuries. The total value of the market for U.S. Treasuries is over $20 trillion. UC Investments holds U.S. Treasuries directly and through index funds.

- Holdings in Blackrock are through index funds.

- Holdings managed by Blackrock are comprised of bonds in UC’s fixed income portfolio.

- Holdings in the 24 companies identified by students in their letter to the Chief Investment Officer are through index funds.

- All holdings are disclosed annually on the UC Investments website.

- As a fiduciary, UC Investments has a legal obligation to maximize the expected return on investments unless directed otherwise by the UC Board of Regents.

As of March 2024, the total size of the UCR endowment was approximately $797.7 million. The endowment has two components: the UC Board of Regents has fiduciary responsibility for $520 million, while the UCR Foundation Board has fiduciary responsibility for $277.7 million. All of the UC Regents component is invested in the General Endowment Pool (GEP) within the UC Investments portfolio, as is more than 99% of the UCR Foundation component. The remaining endowment controlled by the UCR Foundation, approximately $2.7 million, is invested in private equity that includes a venture capital fund (the Highlander Venture Fund) to support UCR-based start-ups and a small investment in Park Street Capital, and cash assets.

As of March 2024, the UCR Foundation also has fiduciary responsibility for $6.6 million in non-endowment assets. These non-endowment assets include UC’s Short-Term Investment Pool (STIP), Charitable Remainder Unitrusts, Cash Assets, and a Student Investment Fund (funds held by the UCR Foundation and managed by Finance students who apply their knowledge of security analysis and investment management to the portfolio).

| UCR Foundation Assets | ||||

| Unaudited as of March 31, 2024 (in millions) |

||||

| UCRF Endowment* | $277.7 | |||

| UC General Endowment Pool (GEP) | $275.0 | Managed by UC Investments | ||

| Private Equity | 2.5 | Primarily the Highlander Venture Capital Fund which includes investments in Basilard Biotech, Nanocellect Biomedical, Sensorygen, and Urban Tribe; also a small investment in Park Street Capital Natural Resource Fund II, L.P. | ||

| Short-Term Investments (STIP) | 0.2 | Managed by UC Investments | ||

| UCRF Non-Endowed Assets | $6.6 | |||

| Short-Term Investments (STIP) | $5.4 | Managed by UC Investments - Funding primarily endowment payout to UCR | ||

| Cash and Cash Equivalents | 0.5 | Primarily recent donations received | ||

| Split-Interest Agreements (CRTs) | 0.4 | Charitable Remainder Unitrusts held with BNY Mellon and managed by UC Investments | ||

| Hylander Student Investment Fund | 0.3 | Funds held by UCRF and managed by UCR School of Business Students as an educational opportunity | ||

| Total UCR Foundation Assets | $284.3 | All assets under the investment control of the UCR Foundation Board. | ||

*The UCR Endowment also includes $520 million in assets under UCOP investment control, in addition to the assets listed in the table.

Overall, about 99% of the total UCR endowment is invested in the GEP and managed by UC Investments. The total invested amount ($795 million) comprises around 3.1% of the GEP, while the UCR Foundation Board component ($275 million) comprises around 1.2%.

The GEP functions like a mutual fund, which means UCR does not directly invest in any individual financial assets through the GEP. Instead, UCR invests in the GEP which holds a variety of financial assets determined by UC Investments. The complete list of GEP holdings as of June 2024 is available here. As of May 2024, approximately $350 million of GEP assets were invested in companies that manufacture, or provide service to, military weapons, weapons components, or weapons systems (based on a methodology used by Morgan Stanley Capital International). The 1.2% share of the GEP held by the UCR Foundation Board represents about $4.2 million of these assets.

UCR will continue to update this site with additional information on our investments. Other currently available information includes the following:

- UC Investments website – Homepage for the Office of the Chief Investment Officer of the Regents.

- UC Retirement Plan (UCRP) policy and holdings – Information about the investment policy and holdings of the UC retirement fund, including recent market values for individual assets.

- General Endowment Pool (GEP) policy and holdings – Information about the investment policy and holdings of the UC endowment, including recent market values for individual assets.

- Short Term Investment Pool (STIP) policy – Information about the investment policy for the UC short-term cash investment pool.

- Total Return Investment Pool (TRIP) policy – Information about the investment policy for the UC long-term investment pool.

- Private Equity Investments – Information about UC private equity investments, including recent market values for individual assets.

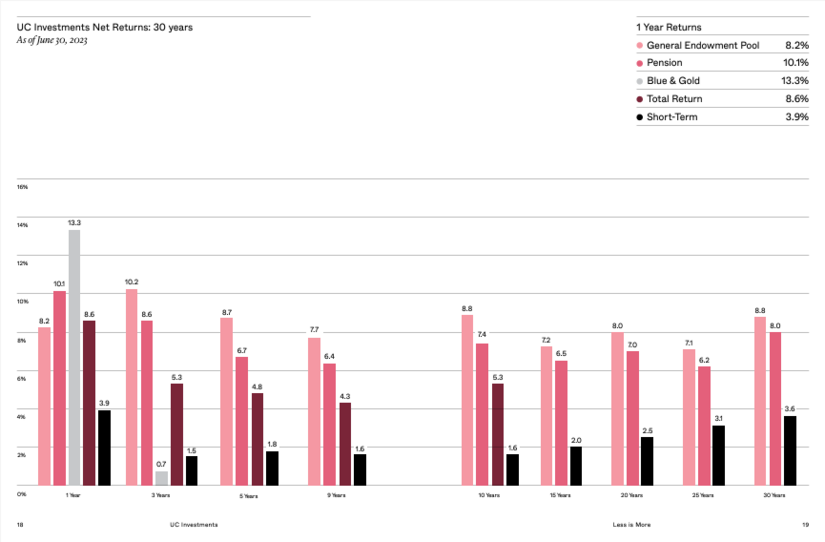

- UC Investments Annual Report (2022-23) – Summary information including investment performance for the UC Investments portfolio for the 12-month period ending June 30, 2023. Annualized net returns, including for the GEP, are summarized on pages 18-19:

- Annual Endowment Report (2022-23) – Investment performance for the campus foundations for the 12-month period ending June 30, 2023. The UCR Foundation is reviewed on pages 38-40.

- UC Retirement System Annual Report (2022-23) – Summary information including investment performance for the UC Retirement Plan investments for the 12-month period ending June 30, 2023.

- Sustainable Investing (ESG factors) – Information about how UC Investments uses environmental, social, and governance (ESG) risk factors in investment decision-making.

- UCR Foundation – Information about the UCR Foundation including philanthropy, the Board of Trustees, and financial statements.

Endowment Taskforce

In 2024, UCR appointed a taskforce to explore investment strategies for the UCR Foundation endowment. In March 2025, the taskforce produced this report.

Taskforce Membership

- Ken Baerenklau, Associate Provost and Professor of Public Policy (chair)

- Beth Claassen Thrush, Director of Strategic Initiatives and Special Projects for the Chancellor and Provost (staff support)

- Kim Yi Dionne, Associate Professor of Political Science

- Elliot Emmer, Senior Director of Development for the School of Public Policy

- Ye Li, Associate Professor of Business

- Alexandra (Sasha) Newton, Associate Professor of Philosophy

- Scott Pegan, Professor of Medicine

- Two graduate students and two undergraduate students from the disciplines of biology, business, education, and political science

This page was last updated on May 2, 2025.